For investors, a clear understanding of a company’s growth stage is essential to making informed decisions. Each stage presents distinct characteristics, risks, and opportunities that can guide investment strategy.

At Cyan Capital, we support companies in accelerating investor discovery and engagement through a comprehensive suite of investor relations and capital markets advisory services, including non-deal roadshows, investor targeting, individual meetings, and communication strategy development.

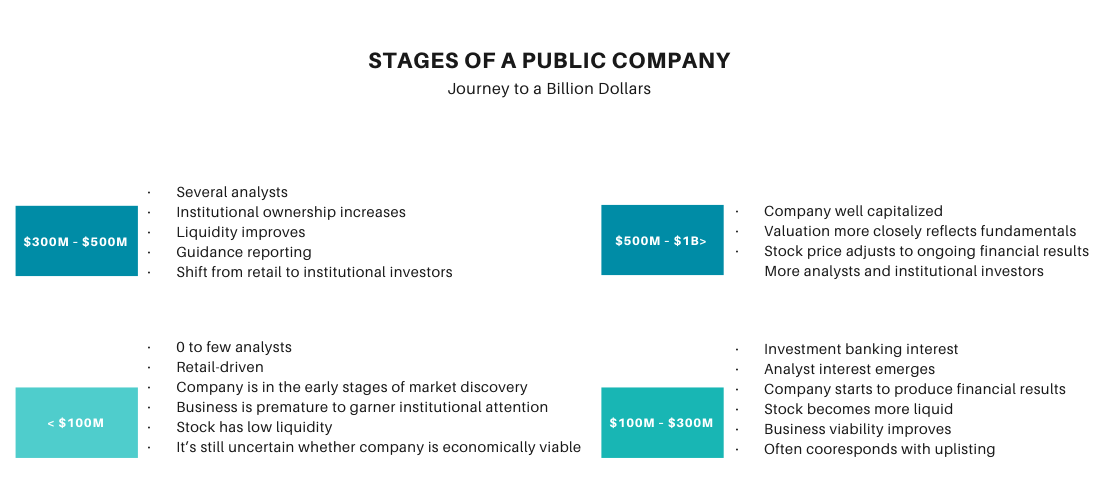

The following outlines the key growth stages of public companies and the unique attributes investors should consider at each phase.

Stage 1: Market Cap Under $100M – Early Development

Companies valued under $100 million are typically in the early stages of development. These companies carry higher risk but can offer substantial upside for investors who identify promising opportunities early.

Key Attributes

- Limited Analyst Coverage — Independent research is critical, as few analysts cover the stock. Investors often discover opportunities through personal networks, events, social media, and industry conferences.

- Retail-Driven Investor Base — Institutional participation is limited due to liquidity constraints, making retail investors the primary stakeholders.

- Early Market Discovery — Business models or technologies are still being validated (e.g., mining companies in exploration or feasibility phases).

- Low Liquidity — Trading volumes are typically low, which can impact the ability to buy or sell shares without affecting prices.

- High Uncertainty — Operational success is unproven, creating opportunities for ground-floor investment with higher risk exposure.

Investor Considerations:

Growth potential is significant, but understanding the company’s roadmap, milestones, management team, and performance history is critical before investing.

Stage 2: Market Cap $100M – $300M – Growth and Validation

At this stage, companies begin to attract broader attention while still in early growth. Investors can gain better insights into potential opportunities.

Key Attributes

- Initial Analyst Coverage — Some investment banks begin providing research, offering greater visibility into financial and operational performance.

- Emerging Financial Results — Financial reporting becomes more substantial, helping investors assess growth potential.

- Increased Liquidity — Higher trading volumes improve market access and reduce price impact.

- Exchange Uplisting — Companies may transition to more prominent exchanges, enhancing transparency and investor confidence.

- Scalability Signals — Operational and business model scalability become more evident as performance metrics are achieved.

Investor Considerations:

Risk remains, but improved transparency and data provide clearer insight into the company’s trajectory.

Stage 3: Market Cap $300M – $500M – Institutional Attention

Companies in this range have established traction in the market, shifting the investment dynamic.

Key Attributes

- Broader Analyst Coverage — Multiple analysts provide research, offering a clearer picture of financial health and outlook.

- Institutional Participation — Institutions begin establishing positions, adding liquidity and stability.

- Improved Liquidity — Trading becomes smoother for both retail and institutional investors.

- Earnings Guidance — Quarterly reports and investor calls enhance visibility into company performance.

- Shift Toward Institutional Focus — Emphasis moves toward institutional relationships, reducing volatility but also limiting retail-driven swings.

Investor Considerations:

The risk of failure diminishes compared to earlier stages, while upside potential remains strong if the company continues executing effectively.

Stage 4: Market Cap $500M – $1B – Growth Maturity

Companies approaching or exceeding a $500 million market cap have demonstrated a proven business model and are positioned for large-scale expansion.

Key Attributes

- Well-Capitalized for Expansion — Companies have sufficient capital to pursue acquisitions and market growth.

- Performance-Based Valuation — Valuations are tied closely to earnings growth and market share performance.

- Performance-Driven Trading — Stock movement increasingly reflects operational execution and results.

- Dominant Institutional Ownership — Institutions comprise the majority of shareholders, providing stability and consistent demand.

Investor Considerations:

Companies at this stage represent stable, high-growth opportunities. Upside potential is more closely linked to consistent execution than speculative gains.

Conclusion: Timing Is Key

Understanding the stages of a company’s growth journey is fundamental for identifying the right investment opportunities. Whether engaging with early-stage innovators or mature businesses nearing the billion-dollar threshold, investors can make better decisions by recognizing the unique risks and rewards at each phase.

At Cyan Capital, we are committed to connecting issuers and investors worldwide, accelerating discovery, and facilitating meaningful engagement.

Stay Informed

Subscribe to receive updates on our upcoming non-deal roadshow events and discover new investment opportunities.